If you’re thinking about starting your own business and acting as your own employer, there’s a bit more to it than just registering a company or finding a startup capital. You might want to consider all available options first and decide on an appropriate entity type.

One of the most popular business types in the United States is a limited liability company (LLC). In some states, you can also form a Professional LLC (PLLC)—a variation on the LLC model operated by licensed professionals in a single field—though not all states support this entity type.

Let’s take a closer look at the key differences between PLLC and LLC to help you decide which business model is best suited for your company.

Navigation

As a business model, the Limited Liability Company is considered to be one of the most advantageous options available, offering benefits from all other entity types in one package. Each owner, for instance, is only responsible for their share in the company and cannot be charged for damages, debts, and other lawsuits brought against the company. This allows each owner to protect their assets and avoid bankruptcy.

In terms of structure and operation, LLC is not that different from sole proprietorships or LLPs, though it depends on the number of owners. The same goes for taxes—LLC owners can choose taxation types to tailor their needs. There is also a number of reputable LLC services providing consultation and assistance with the formation process.

A Professional Limited Liability Company is a type of LLC operated by licensed professionals in a selected field.

Similar to an LLC, a PLLC designates registered agents, drafts operating agreements, and files annual report forms according to LLC guidelines.

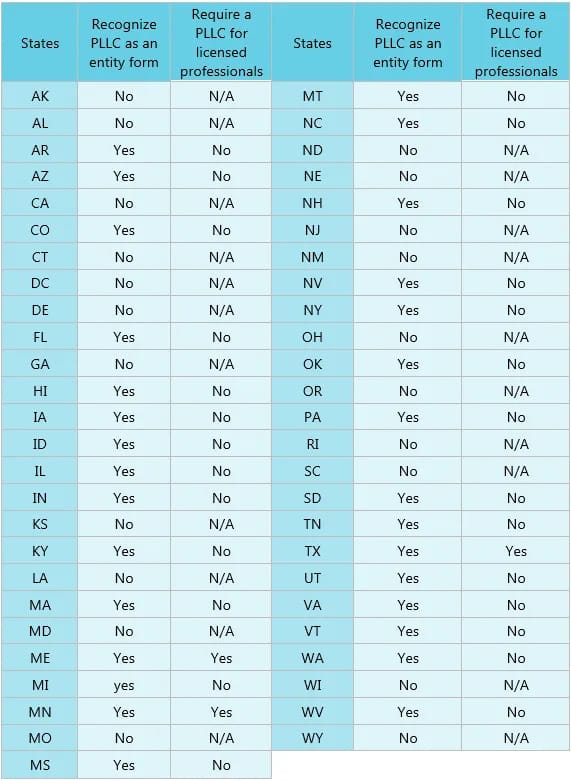

An LLC is not a federal entity since it can only be formed and operated on a state level. As for PLLCs, they can be formed only in select jurisdictions.

Here are the states where you can open a Professional LLC:

According to local state authorities, a PLLC can be formed and run only by certified professionals, though you can encounter different formation processes in each of these states.

The main difference between PLLC and LLC is the inherently specialized nature of the former. Depending on the state, either all or only a certain number of PLLC owners are required to hold valid state licenses in the intended field of operation, most commonly medicine, law, and accounting.

Just like LLC owners, PLLC shareholders are not personally accountable for any legal issues brought against the company itself. Still, an owner can be sued for negligence or abuse of power of authority, hence why so many professionals are covered by liability insurance to minimize damages.

Given that PLLC is another form of a limited liability company, each state imposes its own guidelines for this entity. You will often find that many state laws regarding PLLCs are fairly vague in which case drafting your company’s documents becomes particularly important, down to every little detail.

Both LLC and PLLC models protect their owners against lawsuits brought against the company with the exception of professional negligence.

Additionally, both business types eliminate double taxation. Unlike corporations and partnerships, the two entities allow their owners easier access to the revenue generated by the company and the ability to file for tax returns.

In contrast to incorporated structures, this model has been simplified to allow for closer working relationships and more effective partnerships.

There is no unifying set of guidelines for PLLC formation due to each state imposing different legal requirements. It’s highly recommended to first consult business attorneys in the state of formation to better outline the formation process.

Most states require PLLC owners (all or only a segment) to hold valid licenses, while a number of states allow successors to continue the operation of a PLLC provided they obtain relevant licensing first.

You might also need to be approved by the state’s licensing board (for instance, when all PLLC owners are legally required to be licensed) which can extend the formation times compared to those of LLCs.

After the licensing board approves the owners, it’s time to draft articles of organization and select the company name. PLLC names are typically required to include their designation, either Professional Limited Liability Company or any of the abbreviated versions like P.L.L.C. or PLLC. Some states also require the company’s Articles of Organization to include owner signatures, either one or all of them.

Then you will need to submit your state’s filing fee and draft the operating agreement detailing the company’s operational structure and share allocation.

Forming a PLLC is rather time-consuming and needs a more professional touch. This doesn’t necessarily mean you have to hire expensive lawyers: you can always save money by subscribing to online formation services like IncFile or Northwest Registered Agent instead.

All you need to do is provide relevant information about your and your company after which the formation service will handle the paperwork and deliver the processed documentation once it’s been approved by the state. This might be your best option, especially if you only want to focus on your professional practice.

Despite many states having similar laws regarding LLC and PLLC formation, management, and taxation, there are still quite a few disparities.

Those planning to work in their professional field should always check with their state’s legislation, so you can determine which business model is more suitable for you.

Keep in mind that the Professional LLC model is designed to protect your personal assets but it might be impossible to escape accountability in cases of professional negligence or abuse of power of authority.